Basic Economics: A Citizen’s Guide to the Economy

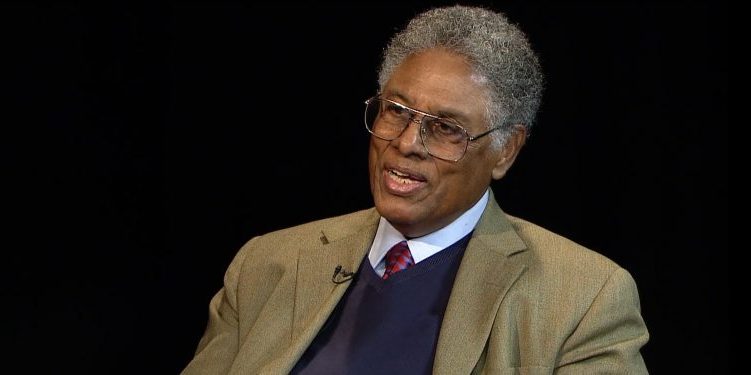

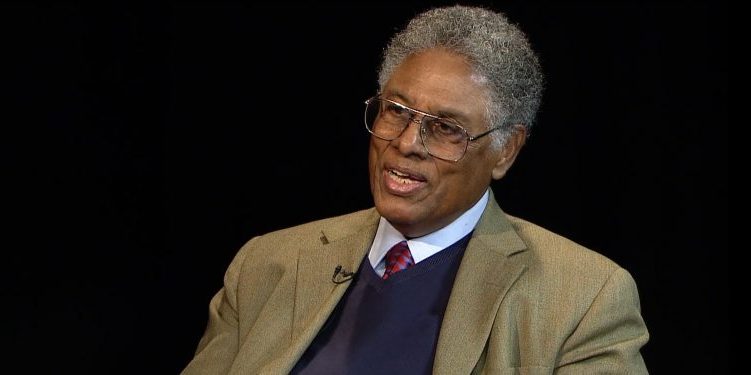

As a bestselling author and syndicated conservative columnist, Thomas Sowell has written, brilliantly, on a wide range of political, social and cultural issues. But it is economics that has always been his specialty — and it is to economics that he returns in a book that, in our judgment, ranks as the finest single-volume treatment of the subject since Henry Hazlitt’s “Economics in One Lesson.”

Like Hazlitt, Sowell is that rare economist who uses plain English, and examples that everyone can relate to, to Basic Economics contains no jargon, no graphs, and no equations. Yet this is no mere “primer,” but a comprehensive survey, offering clear, readable explanations of every important topic in the field — including:

The Role of Prices * Price Controls * The Rise and Fall of Businesses * The Role of Profits — and Losses * Big Business and Government * Productivity and Pay * Controlled Labor Markets * Investment and Speculation * Risks and Insurance * National Output * Money and the Banking System * The Role of Government * International Trade * International Transfers of Wealth

In addition, Sowell devotes an entire section of the book to the “Popular Economic Fallacies” that pass for fact and wisdom in the media, in academia, and in the halls of Congress.

“Much of what follows in the chapters ahead,” writes Sowell in his Preface, “is an analysis of what happens in an economy coordinated by prices and by the resulting flows of money and goods in a competitive market. But it also considers what happens when markets are not permitted to operate in that way, whether because of business, unions, or govemment. One of the best ways of understanding the role of prices, for example, is by understanding what happens when they are not permitted to play their role in the market. How does an economy respond when prices are set or controlled by the government, rather than being allowed to fluctuate with supply and demand? What happens in an economy that is centrally planned, as distinguished from one in which decisions about how to use resources and distribute goods and services are made by millions of separate individuals, whose decisions are coordinated only by their responses to price movements?” The answers Sowell provides point the way to a sane economic policy for America — and will equip you to see through, and refute, the economic falsehoods that threaten your future.

Thomas Sowell takes the liberal economists to school

In a society of millions of consumers, no given individual or set of government decision-makers sitting around a table can possibly know just how much these millions of consumers prefer one product to another, much less thousands of products to thousands of other products. In an economy coordinated by prices, no one has to know. Each producer is simply guided by what price that producer’s product can sell for and by how much must be paid for the ingredients that go into making that product.

During the Great Depression of the 1930s, agricultural price support programs led to vast amounts of food being deliberately destroyed at a time when malnutrition was a serious problem in the United States and hunger marches were taking place in cities across the country. For example, the federal government bought 6 million hogs in 1933 alone and destroyed them. Huge amounts of farm produce were plowed under, in order to keep it off the market and maintain prices at the fixed level, and vast amounts of milk were poured down the sewers for the same reason. Meanwhile, children were suffering from diseases caused by malnutrition.

While capitalism has a visible cost — profit — that does not exist under socialism, socialism has an invisible cost — inefficiency — that gets weeded out by losses and bankruptcy under capitalism. The fact that most goods are available more cheaply in a capitalist economy implies that profit is less costly than inefficiency. Put differently, profit is a price paid for efficiency.

To many people, even today, high profits are often attributed to high prices charged by those motivated by “greed.” In reality, most of the great fortunes in American history have resulted from someone’s figuring out how to charge lower prices and therefore gain a mass market for the product. Henry Ford did this with automobiles, Rockefeller with oil, A&P with groceries, Alcoa with aluminum, and Sears, Wal-Mart and other department stores with a variety of products.

With anti-trust laws, as with regulatory comnissions, a sharp distinction must be made between their original rationales and what they actually do. The basic rationale for anti-trust laws is to prevent monopoly and other conditions which allow prices to rise above where they would be in a free and competitive marketplace. In practice, most of the great anti-trust cases have involved some business that charged lower prices than its competitors. Often it has been complaints from these competitors which caused the government to act.

In countries around the world, discrimination by government has been greater than discrimination by businesses operating in competitive markets. Understanding the basic economics of discrimination makes it easier to understand why American blacks were starring on Broadway in the 1920s, at a time when they were not permitted to enlist in the U.S. Navy and were kept out of many civilian government jobs as well. Broadway producers were not about to lose big money that they could make by hiring black entertainers, but the costs of government discrimination was paid by the taxpayers, whether they realized it or not.

Because job security laws make it risky to hire new workers, existing employees may be worked overtime instead or capital may be substituted for labor, such as using huge busses instead of hiring more drivers for regular-sized busses. However it is done, increased substitution of capital for labor leaves other workers unemployed. For the working population as a whole, this is no net increase in job security. It is a concentration of the insecurity on those who happen to be on the outside looking in.

Media and even academic preoccupation with instant snapshot statistics create major distortions of economic reality. “The rich” and “the poor” have become staples of income discussions, even though most of the people in the top and bottom income categories are the same people at different stages of their lives, rather than fixed classes of people who remain at the top and bottom throughout their lives. Even a couple of economists who should have known better used analogies that treated people in various income brackets as if they were permanently in those brackets. Lower-income people were likened to “dwarfs” less than three feet tall, while people in the top brackets were likened to “giants” 20 feet tall. A much more apt analogy would be between children and adults, since children grow up to become adults, while dwarfs and giants remain dwarfs and giants throughout their lives.

The only animals threatened with extinction are animals not owned by anybody. Colonel Sanders is not about to let chickens become extinct. Nor will McDonald’s stand idly by and let cows become extinct. It is things not owned by an body (air and water, for example) which are polluted. In centuries past, sheep were allowed to graze on unowned land-“the commons,” as it was called — with the net result that land on the commons was so heavily grazed that it had little left but patchy ground and the shepherds had hungry and scrawny sheep. But privately owned land adjacent to the common was usually in far better condition.

What is called “foreign aid” are transfers of wealth from foreign governmental organizations to the governments of poorer countries. The term “aid” assumes a priori that such transfers will in fact aid the poorer countries’ economies to develop. In some cases it does, but in other cases foreign aid simply enables the existing politicians in power to enrich themselves through graft and to dispense largess strategically to others who help to keep them in power. Because it is a transfer of wealth to governments, as distinguished from investments in the private sector, foreign aid has encouraged many countries to set up government-run enterprises that have failed.

The case for a free market is not that it benefits business, but that it benefits consumers. It is a sad commentary on our times when that case is not debated on its own merits, but instead the motives of those who make that case are impugned and they are presumed to be agents or apologists for business interests who are in fact often opposed to free markets.

Tags: Basic Economics: A Citizen’s Guide to the Economy, Thomas Sowell

- The Author

Thomas Sowell

Thomas Sowell is the Rose and Milton Friedman Senior Fellow on Public Policy at the Hoover Institution. His current research focuses […] More about Thomas Sowell.

- Books by the Author

- Related Articles

Episode #5 – Interview with the Legendary Thomas Sowell: His New Book, His Legacy, and What He Thinks of Trump and the Future of America

The legendary conservative economist Dr. Thomas Sowell sat down with us for an exclusive podcast author interview about his new book, Discrimination[...]

Thomas Sowell’s 5 Best Conservative Books

Thomas Sowell is one of America's best economic thinkers. For years, Thomas Sowell has tackled left-wing ideas, so we compiled[...]

Member of the Week: Isaac Woodward (Former John Jay Fellow)

Our featured CBC Member of the Week is Isaac Woodward - former John Jay Fellow at the John Jay Institute[...]

National Review Comes Out “Against Trump”

National Review, the flagship conservative magazine started by conservative icon William F. Buckley, Jr, has released their latest issue of […]

Ratings Details