Wealth and Poverty: A New Edition for the Twenty-First Century

No one believes in socialism any more, says George Gilder in his new book, ”Wealth and Poverty,” adding that the only people who thoroughly believe in capitalism are those who have never experienced it.

”Wealth and Poverty” offers a creed for capitalism worthy of intelligent people. Mr. Gilder has written the kind of good book that alternately astonishes the reader with new and rather daring insights into familiar problems and bores him with long, tract-like passages to support them, particularly on ”supply-side” economics, which is concerned with the problems of encouraging production instead of the difficulties of distribution. At times, he offers startling anthropological data and references to elaborate studies of the business cycle over hundreds of years. At times these same areas seem irrelevant to his case.

Mr. Gilder can be witty and, sometimes, obvious; persuasive and sometimes highly questionable. His case will surely not convince the confirmed anti-capitalist, nor will it quell the doubts of procapitalists who have lived through some of the seedier periods of recent history. But at the core he provides, at least for this not totally disinterested reader, a sense that on crucial matters of human value, capitalism offers a system of economic arrangements more congenial than the alternatives, not simply because the alternatives are less pleasant, but because they are based on a mistaking of the conditions of human life.

The book constitutes a defense-in-depth, a series of arguments in favor of capitalism, which must be breached, if at all, one at a time. When one reaches the core, one has the uneasy sensation that Mr. Gilder is defending not only capitalism per se, but an immediate tax cut in 1981. The addition of this secondary motif, while somewhat distracting, does not diminish the force of the defensive arguments. Mr. Gilder’s position in favor of the tax cut and of inflation as a preferable alternative to government-imposed taxes, merely suggests that the return to a truly capitalist society presents problems.

As for capitalism itself, Mr. Gilder points out as his first defense that it is based on a sounder economics than its rivals. It explains the basic issue of economic life: what makes men productive. Capitalist economics recognizes that the questions of distribution that have occupied so much time in the critiques of its detractors, are subsidiary to the basic problem of production: Without it, there is nothing to distribute.

For those who doubt that the tax concessions of ”supply-side” economics will really stimulate production as much as promised, Mr. Gilder offers an ethical defense based on anthropological verities. In primitive societies, he says, the accumulation of goods was not a selfish activity in the narrow sense. Rather, it was based on the ”gift relationship” that inspired certain men to accumulate property so that they could give it away to their fellow tribesmen. The gift was prompted not by a contractual expectation of reward, but by hope itself, though held under the shadow of risk of failure. In support of this theory of the origins of capitalism, the author refers us to numerous authorities whom I am unable to evaluate. (Regrettably, he includes among them Helen Codere, who describes the ”potlatch” tradition of the Kwakiutl Indians of the Northwest. As a sixth-grade student in a progressive school, I developed an unreasoning horror of the terms ”potlatch” and ”kitchen middens,” possibly because I was always afraid to seem foolish by asking what they meant. I assumed they must have been household implements with which my classmates were intimately familiar.) I find Mr. Gilder’s account of the gift relationship interesting, but am unable to draw a connection between it and the rise of industrial capitalism centuries later on the other side of the globe. Experts may do better.

Mr. Gilder, however, explains that systems like socialism base their production on the certainty of a limited future, believing that all great innovative discoveries and inventions have already been made. Socialists, he says, are motivated by a spirit antithetical to the gift relationship in which one proffers what one knows in the hope of getting something unheard of, unknown, in return. He claims that the mercantilist tradition made the same error that socialists make, assuming that wealth is tangible and limited, while in fact, he argues, true wealth is intangible, consisting of the fertility of the human imagination that can be liberated only by a leap into the unknowable future. Those who clamber over this ethical line find themselves facing what might be called Mr. Gilder’s biological defense. He describes capitalism as consonant not only with the higher, more ethical human possibilities, but with mankind’s essential nature. Poverty, he tells us, can be overcome only by a human society that has accepted three basic relationships, activities, states of mind. They are work, family and faith. Any reader of Mr. Gilder’s earlier books – ”Naked Nomads,” for example – will recall the dangers he sees in the unmarried male, the vital necessity of a marriage tie in order to bring out, or rather tame and turn into constructive channels, the primal male energy. In ”Visible Man,” the account of a talented young black spoiled by the too-ready indolence of America’s welfare system, Mr. Gilder expressed a view of the cruel hoax imposed largely on black America by the false charity of the Aid to Families With Dependent Children program.

What comes on the reader unexpectedly in this third defense of capitalism, is the extraordinary importance Mr. Gilder attaches to the persistence of faith:

”Faith in man, faith in the future, faith in the rising returns of giving, faith in the mutual benefits of trade, faith in the providence of God are all essential to successful capitalism. All are necessary to sustain the spirit of work and enterprise against the setbacks and frustrations it inevitably meets in a fallen world; to inspire trust and cooperation in an economy where they will often be betrayed; to encourage the forgoing of present pleasures in the name of a future that may well go up in smoke; to promote risk and initiative in a world where the rewards all vanish unless others join the game.”

As the passage suggests, capitalism poses the dangers of inherited wealth and other temptations to undermine the principle of work, and there are capitalists who mistake the nature of their system and undermine its most constructive values in the course of seeking to maximize their benefit from it. But Mr. Gilder claims that the hazards of socialism and crucially moderated capitalism (he never truly defines how much pure capitalism may safely be modified) are greater. The indolence, underachievement and sapping of faith in the future do not simply reduce the productivity of the economic system, they corrode the people who are part of it.

Finally, to skip several of the defense perimeters, Mr. Gilder argues that capitalism works because it does not seek to evade the notion of risk. It accepts the possibility of failure as an intrinsic element in human life and encourages people to live fruitfully in the shadow of failure. He claims as a ”good” the very quality of chance that current egalitarian writers argue plays too important a role in deciding who gets what in a capitalist society. He quotes Christopher Lasch to the effect that capitalism rewards people without regard to their intrinsic merit (never mind who is to determine what the intrinsic merits are and how their existence is to be agreed upon), and then he argues that the acceptance of chance as a determining factor in human life is the necessary precondition of freedom, which Mr. Gilder regards as higher good than equality. When a society as a whole tries to eliminate chance, it must project the patterns of its past into the future because they constitute the only certainty, and those patterns are clung to long after they have lost their natural markets, long after they have stopped responding to human needs.

Now all of this may be as persuasive as it is elegant in its comparison of two social orders – capitalist and socialist. It seems to me stronger as a defense of the capitalist himself than of the system that gives him scope and then, as Mr. Gilder puts it, hates him for the wealth he has achieved. Mr. Gilder seeks, perhaps for the benefit of those who grew up when American capitalists were identified ineluctably as robber barons, to explain the work the capitalist entrepreneur undertakes. He assumes the risks, and exercises the intellectual and moral energy necessary to assemble the capital needed to introduce a new product or service that forms a market for itself.

Undoubtedly, those who assembled economic power to make an industrialized society possible had to develop the unpleasant characteristics that their critics have described. They may well have been drawn from among those who did in fact possess those characteristics to begin with. But it is really of no more ultimate significance to decry the capitalist personality than to recall the gift relationship of the Kwakiutls to praise their generosity. The test of the value of capitalism is whether the society made possible by it improved the conditions of life for the vastly increased population that their industry made possible. And then there is the second test: whether an alternative economic arrangement can improve on the defects of capitalism without even more grossly undermining its achievements. On this point it seems to me that Mr. Gilder is on the most secure ground in arguing that capitalism can be defended. The mildest criticism of the existing socialist states is that they have not released the immense flow of human energy that their advocates predicted would follow the end of private ownership of factories.

For a moral philosopher, which Mr. Gilder considers himself, it is not enough to deal with failure; one must also confront the problem of evil. Why, if capitalism is on balance so fruitful, has it been modified into a condition of low productivity and stagnation? Mr. Gilder rejects the regression from the entrepreneurial stage to the bureaucratic stage as the inevitable result of a society’s aging. Instead, he blames the progressive income tax, claiming that he would rather pay for the excess costs of a modulated capitalism by inflation than by continuing the tax rates that discourage entrepreneurial energy.

At this point, the book finishes off with a coda that bears little connection with the thematic material that has preceded it. He theorizes that the economics of the ”Laffer curve” will make possible increased productivity without increasing inflation by providing a higher flow of tax revenues at lower rates because the lower rates will stimulate greater economic activity. Reviewers are not expected to pass judgment on predictions of this kind. Perhaps Mr. Gilder is right (assuming that the Reagan Administration adopts Laffer economics) and capitalism will be retrieved from the evils of the progressive income tax. But even if he is wrong, the book stands as an eloquent defense of the capitalist high ground and the human values that capitalists, despite their bad manners and admitted defects, managed to embody to the benefit of their fellows.

Book Review from The New York Times, by Roger Starr

Tags: George Gilder, Wealth and Poverty: A New Edition for the Twenty-First Century

- The Author

George Gilder

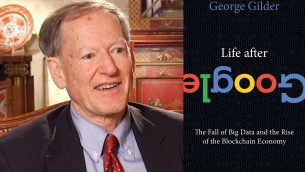

**Exclusive CBC Author Interview with George Gilder** George Gilder is a New York Times bestselling author, journalist, and preeminent economic […] More about George Gilder.

- Books by the Author

- Related Articles

Episode #24 – George Gilder Interview: Google Marxism and the End of Privacy

Legendary economist and technological icon George Gilder tells the story of how Google took over the internet, ended our privacy[...]

5 Facts You’ll Need To Know About “Life After Google”

Are you ready for a "LIfe After Google"? Read our rundown of George Gilder's latest book "Life After Google" and[...]

Can the Gold Standard Bring Back A Golden Age? (Author Interview: George Gilder)

Famed economist and father of of supply-side economics, George Gilder, releases a new groundbreaking book promising to unveil a radical[...]

Ratings Details