The End of Prosperity: How Higher Taxes Will Doom the Economy — If We Let It Happen

For the past 25 years, the United States has enjoyed a wave of prosperity almost unprecedented in history. But it wasn’t a fluke — it was the direct result of supply-side economics, a.k.a. Reaganomics. Ironically, however, while the rest of the world is now following the American growth model of lower tax rates, more economic freedom, and sound money, America seems to be reversing course, putting our hard-won prosperity at risk. Now, in “The End of Prosperity: How Higher Taxes Will Doom the Economy — If We Let It Happen,” Arthur Laffer (“the Father of Supply Side Economics”), Stephen Moore of the Wall Street Journal, and investment expert Peter J. Tanous explain why the policies of Democrats such as Barack Obama and Nancy Pelosi will cause the U.S. economic growth machine to grind to a halt — and show you how to protect yourself if they get their way.

Citing tax-cutting lessons from the administrations of Calvin Coolidge, John F. Kennedy, Ronald Reagan and George W. Bush, the authors provide solid evidence that tax reductions increase tax revenues and spur economic growth. They also show how phasing out the Bush tax cuts in 2010 — which will happen automatically unless Democrats vote to extend them — will send the economy into a tailspin that may take years, perhaps decades, to pull out of.

Some of what you’ll learn in The End of Prosperity:

- The assault on growth: How politicians, especially Democrats, are getting everything wrong on taxes, spending, regulation, trade and monetary policy

- The four killers of prosperity and bull markets, as demonstrated by the 1930s and 1970s — and how Congress is sending us down the same road today

- Why, if a new Congress decides to impose tax increases — even if just by not renewing the Bush tax cuts — the effect on our economy will be devastating

- A 50% bracket in your future? How Obama’s tax plan makes that a real danger for many middle-class taxpayers

- The new wave of trade protectionism: how the people it will victimize most are the poor and middle class

- How a cocktail napkin changed the world: the six enduring lessons of the “Laffer Curve” and supply-side economics

- Uncle Sam vs. Economic Reality: how today’s policymakers cling to the long-discredited idea that higher tax rates yield higher tax revenues

- “We Can Do Bettah”: how JFK’s tax cuts spurred an economic boom while massively increasing tax revenues — and other tax-cutting lessons from the 20th century

- Crash! The key role of higher tax rates in causing the stock market crash of 1929

- Honey, We Shrunk the Economy: how the “Four Stooges” of the American presidency — LBJ, Nixon, Ford, and Carter — created the most severe and prolonged economic downturn since the Depression in the years 1966-1982

- The 25 Year Boom: How Ronald Reagan changed the economic trajectory of America (and how Bill Clinton tried to steal some of the credit, but doesn’t deserve any)

- What “war on the middle class”? How real median household income rose dramatically during the Reagan years — a stark reversal of the income trends in the 1970s

- How both the rich and poor got richer during the Reagan era, contrary to liberal propaganda

- Why Bill Clinton with a Democratic Congress was a recipe for economic disaster — and how Clinton with a GOP Congress produced a gravity-defying economic expansion

- How the U.S. economy pivoted into recovery almost the very day when the 2003 Bush tax cut was signed into law

- How the divergent fiscal policies of the 50 states illustrate the importance of taxes, regulation and government overspending and debt on economic prosperity

- The Laffer Curve goes global: How supply-side economics is taking the rest of the world by storm — and producing economic “miracles” in Ireland and Eastern Europe

- Death and taxes: how the estate tax does significant harm to the economy — yet raises very little revenue

- Many Happy Returns: how the flat tax can fix our dysfunctional tax system once and for all

- The Death of Economic Sanity: 10 mostly bipartisan policy trends — on taxes, monetary policy, trade, energy, unions, health care and more — that spell big trouble for the U.S. economy in the coming years

- Protecting your investments in the troubled times ahead: specific asset classes you should consider during periods of stock market turbulence and decline, rising inflation, and greater volatility and risk in the financial arena

“Our book is not meant to make a partisan case for one political party over the other,” write the authors. “There are a lot of Democrats AND Republicans who don’t have their tray tables in the upright and locked position when it comes to understanding sound economics. The warning we give here is offered to both parties. It is a call to arms, an appeal to reason to all Americans, and especially to those who seek public office.”

- The Author

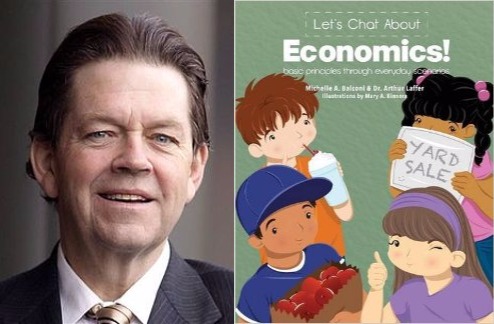

Arthur Laffer

Arthur Betz Laffer is an American economist who was a member of President Reagan’s Economic Policy Advisory Board (1981–89). Laffer is […] More about Arthur Laffer.

- Books by the Author

- Related Articles

Arthur Laffer’s New Economics Book for Children (Author Interview)

Dr. Arthur Laffer, famed economist, and writer Michelle Balconi, discuss their new economics book -- for kids, in our exclusive[...]