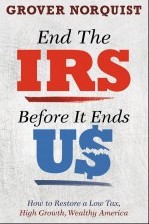

End the IRS Before It Ends U$: How to Restore a Low Tax, High Growth, Wealthy America

** Exclusive CBC Author Interview with Grover Norquist **

In his most important work to date, Grover Norquist pulls no punches outlining the linkage between taxation and tyranny in his new book, End The IRS Before It Ends U$. The facts in Norquist’s book illuminate like a bolt of lightning. The facts cited regarding taxation, from the pre founding of our republic to today, lead to one conclusion; government cannot be trusted with increasing amounts of the hard earned money of hard working Americans.

Writing the first part of his book in a historical tone, Mr. Norquist points out that before the American Revolution, the colonists were being taxed at a rate between one and two percent. The possibility of such taxation increasing to three or four percent was enough to launch the War for Independence.

Put another way, taxes have increased a minimum of 1,600% since the American Revolution. Other statistics pointed out by Norquist are equally as frightening and troublesome.

The federal government owns almost 28 percent of the land in the United States. In some states, the federal government owns more than 50 percent of the land. Norquist points out that the government does not sell this land nor do they even want to explore leasing it.

His book is sure to stir anger as one is left with the impression that those in government have forsaken their oath to the people, and grab more power while the people suffer under and increasingly heavy handed elite.

Up to 50 percent of every dollar Americans create is taken by some entity of government. Norquist points out that in the Middle Ages that percentage was 20-25 percent;, which was high enough to to stir great discontent even back then. Yet current taxation rates are still not high enough for the government.

Government programs are nearly bankrupt, and government, which is supposedly accountable to the people, is now looking to break even more promises by taking more money from the people; this time through taxpayer’s retirement accounts

Norquist also recounts the scandals of the IRS; scandals that show a clear and present danger to the safety and security of our people. The level of standard the people are willing to accept from the IRS is frightening, which is part of the reasoning behind Norquist’s call for action and large tax cuts.

Mr. Norquist argues forcefully that such tax cuts are the only way to shrink the size and scope of government. Deals cannot be made to increase spending in one area and decrease spending even more in another area because those deals are always broken, such as was seen when leftists broke their agreement with President Reagan in the early 1980’s.

Norquist argues the left cannot be trusted with deal making nor can they be trusted with our tax dollars – citing continuing bankruptcy of government programs as evidence. Ironically, tax cuts have always increased government revenues as seen by tax cuts initiated by Calvin Coolidge, John Kennedy, and Ronald Reagan.

Perhaps the most powerful chapter in the book is when Norquist describes a day in the life of an ordinary American, the IRS –the stalker of the average citizen. This dissection will open the eyes of even the most informed American as to how large a role the government has in their life.

The other, more encouraging, part of the book is the solutions offered. Norquist calls for an end to the IRS through a Flat Tax– though other conservatives put more faith in the Fair Tax. . Additionally, Norquist highlights with excellent detail the success that individual states have had in ending taxation while increasing revenue.

Beyond the policy objectives, the book contains practical advice for individual Americans on how they can take steps to help keep the IRS away from their money. While discussing the death tax, Norquist humorously suggests people would be well off to not die or, at least, move to a state without a death tax. Every American would be wise to take these steps; steps that not only would benefit them financially but also educate them in tax code.

This book is an important and necessary read, for policymakers and citizens who wish to decrease government power, increase economic growth, and hand more power back to ordinary people.

Mr. Norquist rose at 4 a.m. each morning to write End the IRS Before It Ends U$. His hard work is evident, and the enemies of freedom and liberty will have to rise even earlier if they hope to defend one of the most powerful government agencies in history.

Original CBC review by Larry Provost.

- The Author

Grover Norquist

** Exclusive CBC Author Interview with Grover Norquist ** Video Endorsement from Grover Norquist below! Grover Norquist is president of […] More about Grover Norquist.

- Books by the Author

- Related Articles

Grover Norquist Endorses The Conservative Book Club!

Grover Norquist, President of Americans for Tax Reform, has endorsed the Conservative Book Club!

Exclusive Author Interview with Grover Norquist

Interviewed Americans for Tax Reform President, Grover Norquist, to discuss new book - "End the IRS Before It Ends Us."